Issued the world’s first resilience bond, “TOKYO Resilience Bond”

The Tokyo Metropolitan Government has been preparing the “Tokyo Resilience Bond,” a metropolitan bond whose funds will be used specifically for projects targeted under the Tokyo Resilience Project [Note 1].

We are now pleased to announce that the outline has been finalized and we will be issuing the world’s first resilience bond (internationally certified).

[Note 1] About the Tokyo Resilience Project

In response to the worsening climate crisis and other issues, the report clarifies the vision for a resilient Tokyo in the 2040s and outlines the overall measures being strengthened to achieve this goal.

1 About the “TOKYO Resilience Bond”

(1)Overview

Urban resilience against natural disasters brought about by climate change has become a common global issue.

In light of this background, Tokyo Metropolitan Government will issue the “Tokyo Resilience Bond” to financially support the Tokyo Resilience Project. Furthermore, by issuing the bond in overseas markets, Tokyo will disseminate information about its resilience efforts to the international community and promote global investment in this field, aiming to become a leading city in sustainable resilience finance.

Issue size

Equivalent to 50 billion yen (foreign currency)

Publication date

Scheduled for mid-October

(2)Planned use of funds

| Target business | Main measures |

| Development of small and medium-sized rivers | To deal with heavy rain, etc., construction of embankments and regulating ponds |

| Tokyo Port and Island Coastal Conservation Facility Development Project | Raising seawalls and other structures to prevent damage from high tides |

| Earthquake and water resistance of river facilities | Strengthening levees and other structures to prevent damage from storm surges |

| Promoting the elimination of utility poles | Electric wires are buried underground to prevent poles from collapsing due to storms, etc. |

| Development of landslide prevention facilities and coastal protection facilities | Developing erosion control facilities and revetments to prevent landslides caused by storms and damage from waves |

| Port construction project | Improved resistance of quays and other structures against waves caused by storms |

*Both projects are part of the Tokyo Resilience Project and contribute to responding to wind and flood damage that is becoming more severe due to climate change.

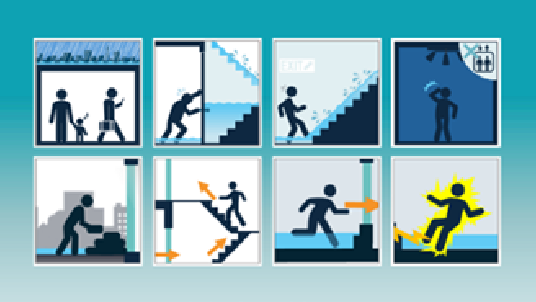

Specific example of usage

2 Acquisition of international certification (Climate Bond certification)

Green bonds (bonds that contribute to solving environmental problems) are examples of bonds with limited uses of funds, and Tokyo was the first local government in Japan to issue them, leading the development of the domestic market.

When issuing such bonds, it is important to obtain certification under international standards to demonstrate that the use of the funds raised is consistent with the objectives, thereby increasing their appeal to investors.

Meanwhile, until now, there have been no international standards for bonds that contribute to achieving resilience.

In this context, the Climate Bonds Initiative [Note 2], an internationally recognized authority in the development of bond issuance standards, has revised its Climate Bond Standards and developed certification standards for the Climate Bond Resilience Taxonomy to encourage investment in climate change adaptation.

[Note 2] About the Climate Bonds Initiative

A leading NGO in mobilizing international funds to combat climate change, it promotes the growth of the green/sustainable bond market through a science-based framework that includes standards, certification systems, data and analysis, and policy recommendations.

The “TOKYO Resilience Bond” will be certified under this system and is expected to be the world’s first resilience bond (internationally certified).

By obtaining this certification, Tokyo Metropolitan Government aims to gain support for the “TOKYO Resilience Bond” from many investors.

The Climate Bonds Initiative has also issued a press release regarding the acquisition of this certification, so please see their website (link is external site).

(Reference) “TOKYO Resilience Bond” framework and evaluation report

The framework that defines the use of funds and management methods for the Tokyo Resilience Bond, as well as the third-party evaluation report, are available on the Tokyo Metropolitan Government website.

This project is an initiative to promote the “Tokyo 2050 Strategy.”

Strategy12: Global Finance

Strategy21: Urban Resilience

| Contact: Finance Bureau, Accounting Department, Public Debt Division Phone: 03-5388-2681 |

その他のお知らせ

-

Earthquake

Earthquake -

Earthquake

Earthquake -

Wind and flood damage

Wind and flood damage -

Earthquake

Earthquake